I wanted to make a video focusing on the strategy that I’ll be using for the $25k Trading Challenge. We got off to a bumpy start and this is really due to two things.. (1) a lack of proper account and position size allocation which we’ve fixed and (2) not being fully decided on a trading strategy. So that’s why in this video I’ll be reviewing the exact trading strategy I’ll be using throughout the challenge.

Overview

- A Continuation Setup

- Popularized By Ross Cameron (Warrior Trading YT Channel)

- Trade 9:30 – 10 AM (Sometimes allowing pre-market trading)

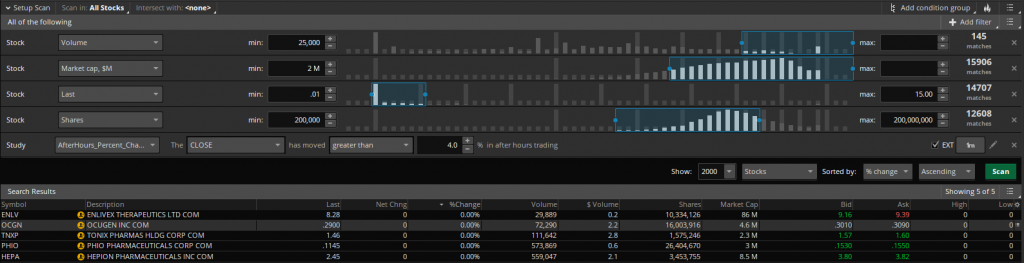

Scanner

- Run scan pre-market

- Float < 50 Mil

- Requirements stock should have a catalyst or be a former runner

- Price range $1.5 – $10

On avg. 2-4 setups should present themselves on the scanner.

Checklist

- Scan for all Gappers

- Prioritize low float stocks

- Hunt for catalyst for the gap (earnings, news, PR, etc.)

- Mark out pre-market chart for support/resistance

- Prepare order before market opens

- Be ready as soon as market opens

- Focus on 1-2 stocks after market opens

Ideally a stock gapping between 5-10% and is consolidating pre-market in the top 20% of the pre-market range (NOT overly extended or selling off already). Look for a stock with a defined pre-market flag and that can run at least another 20-30%

Gap & Go Strategy Entry Setups

- 1min opening range breakout

- Break of pre-market highs

- First pull back

- Second pull back

- Red to Green Move (mini Morning Panic) (ONLY on gappers)

- 1min Micro pull back

View videos linked below for my details about these entries. I’ll be using my TradeJournal.co to track with entries/setups work best for me.

Look for stronger entries near half dollars and whole dollars. (Ex. a break above 1.5 there’s a good chance there will be a bigger move to the next major half or whole dollar resistance. This also provides a clear stop.

Ideal Exits & Stops

Roughly for $5 stock max hard stop -20 cents. Profit targets 20-40 cents (That’s an ideal 4% max S/L and 6% profit zone). This produces a profit loss ratio of roughly 1.5:1, which means your profitable even at a 50% success ratio. However, focus on the best trades 3:1 P/L especially when limited to trades due to PDT.

Gap And Go Exit Indicators

- Heavy resistance on level 2 (ex. big seller than bail by selling on bid)

- Buying slows down and selling increases on the “Time & Sales”

- First profit target reached and buying is strong sell half at Ask and Adjust stop to breakeven for reminder

- If entry was due to 5min chart than look for first red candle on the 5 min chart. View #3 for follow-up.

Breakout or Bailout

If trade isn’t working in the first 5min of entering the trade often just bail or breakeven. These are momentum patterns and if momentum is not there that usually means it’s time to leave.

You can watch this whole trade above play out via this live stream video. Checkout the first pinned comment to go right to the entry or watch the whole video to learn this strategy be put in action.

Additional Resources:

Continuation Patterns

- Bull flags

- Bear flags

- Flap Top Breakouts

- Flat Bottom Breakouts

- 1234 Patterns

- Micro 1 Min Pullbacks

- Red to Green Moves

- Open Range Breakouts

Gap and Go Trading Strategy Study Material

Two super gold videos where I got a lot of info from

Comments

One response to “Momentum Trading | Gap & Go Strategy”

Nice Enzlo – what’s your relatiionship with Ross? Would love to see if we could collab. check us out at mometic.com