At the beginning of this video, we’ll do a quick little overview of each app – Skip to 4:50 in the video to start with the stock exchange fees.

Trading Fees

$0 (No OTC)

Margin

5% Flat*

Market Data

$5 Gold* Required for margin trading

Kinda starts making you realize how amazing TD Ameritrade is.. not to mention the super awesome Think or Swim platform they have.

Their mobile app is pretty good as well.

F.A.Q’s

What are Regulatory Trading Fees?

Good question I skipped over them because although they affect everyone they are very very low and it’s something I actually for years never even noticed. However, I think I could make a very mini video about the topic in the future. Here’s the gist…

They are fees that the SEC and TAF charge everyone on every sale of stock.

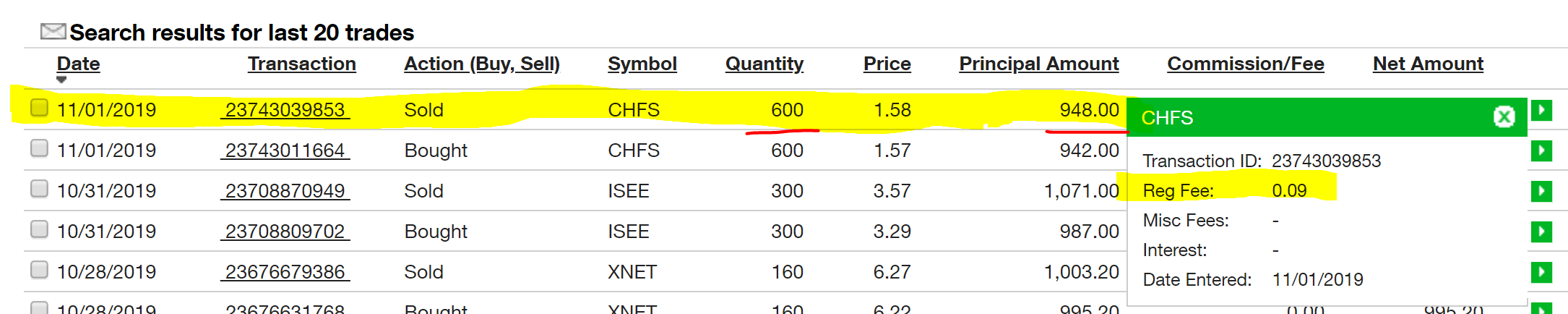

Here’s an example of my last trade’s SEC and TAF fees:

948 * (20.70 / 1,000,000) + 0.0001119 * 600 = $0.0867636

The image below outlines these fees in my TD Ameritrade account. You can plug and play the #’s in the image with the formula above. 600 shares and the principal amount of 948. Also, notice that TD charges a different SEC fee than Robinhood. I’m not aware of why that is.

When Are Regulatory Fees Paid?

The regulatory fees are realized as soon as you sell. You’ll never even see the full profit. Which is probably for the better. Since everyone here who’s self-employed knows how heavy that annual/quarterly tax bill can be.